Prosperity Life Medicare Supplement Update 2024

What is happening and why:

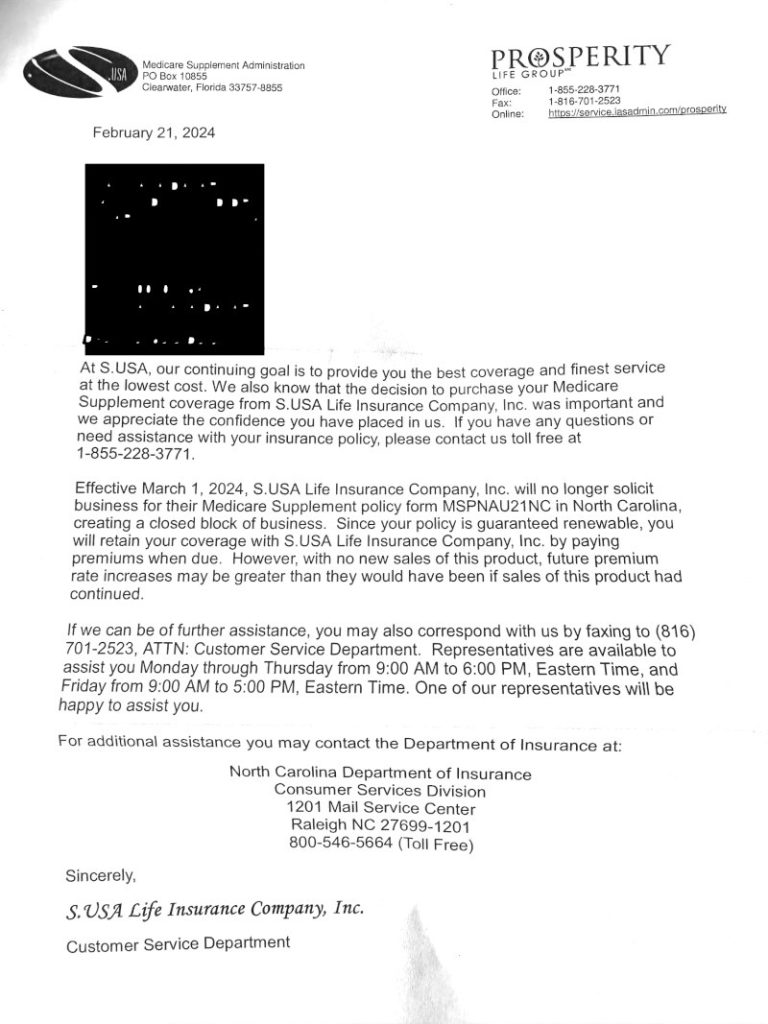

Letters from Prosperity Life went out to clients in February, 2024.

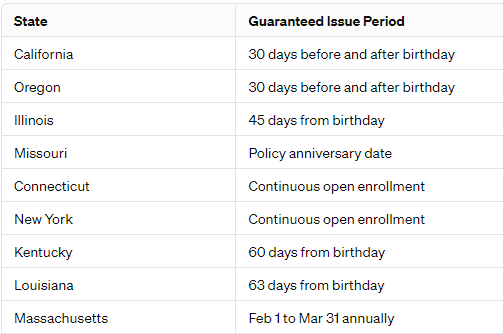

The letter states that Effective March 1, 2024, S. USA Life Insurance Company, Inc. will no longer solicit business for their Medicare Supplement policy in (your state), creating a closed block of business.

These policies are guaranteed to renew, but the rates at which they will increase are concerning to us.

Please see the letter sent to clients:

Click here to make an appointment to review your options, or wait until your policy's next renewal notice.

Using this button is much easier and faster than calling.

You can go through Underwriting to change Medicare Supplement companies 365 days per year.

What is involved in Underwriting?

Explained here: Click This Link

When a Medicare Supplement insurance company designates a plan as being in a “closed risk pool,” it means that the plan is no longer open to new enrollees. This can have several implications for clients who are part of these closed plans:

1. **Stable Group of Enrollees**: Since no new members can join, the risk pool (i.e., the group of individuals covered under the plan) becomes fixed. The members of this group age together, without younger, potentially healthier individuals joining the plan to balance the risk.

2. **Potential for Higher Premiums**: Over time, as the risk pool ages and the likelihood of health claims increases, the insurance company may raise premiums to cover the higher costs. Since these pools can't offset these costs with new, healthier enrollees, premiums for closed plans can increase faster than those for plans that are open to new members.

3. **Less Risk of Selection Against the Company**: For the insurance company, closing a plan to new enrollees can protect against adverse selection, where individuals with a higher likelihood of using health services disproportionately enroll in the plan, increasing costs for the insurer.

4. **Quality of Care and Service**: The level of care and service should not change for members of a closed risk pool. However, the financial health of the insurance company and how it manages its closed and open plans can affect the resources allocated to servicing each type of plan.

5. **Limited Options for Plan Changes**: Clients in a closed plan may find they have fewer options if they wish to switch to a different plan offered by the same company, as other plans may also be closed or have different eligibility requirements.

6. **Market Competition and Plan Viability**: The dynamics of the insurance market can affect closed plans. If many insurers close their plans to new enrollees, the competition and options for consumers may decrease, potentially impacting the viability and cost-effectiveness of remaining plans.

Understanding these implications is important for clients in closed-risk pools to make informed decisions about their healthcare coverage. It's also advisable for clients to regularly review their coverage and consider their options, especially during open enrollment periods, to ensure their current plan continues to meet their healthcare needs and financial situation.

Click here to make an appointment to review your options, or wait until your policy's next renewal notice.

Using this link is much faster and easier than calling.

We are here to help.

Make sure to subscribe to our Youtube channel for Medicare updates!

Make sure to subscribe to our Youtube channel for Medicare updates!

CLICK HERE TO SUBSCRIBE

Senior Savings Network

1-800-729-9590

Prosperity Life Medicare Supplement Update 2024 Read More »