Maximum Out of Pocket on Medicare Advantage: Explained

Table of Contents

- Introduction

- Understanding Maximum Out of Pocket (MOOP)

- The Benefits of MOOP

- Limitations and Considerations

- FAQs

- Conclusion

Introduction

What is Medicare Advantage?

Medicare Advantage (Part C) is an “all in one” alternative to Original Medicare. It's like that swiss army knife you've always admired – it combines hospital insurance, medical services, and often includes prescription drug coverage. But like every tool, it has its nuances.Why is MOOP Important?

Think of MOOP as a safety net. It's a feature that makes sure you don't end up in a free fall when it comes to healthcare costs. Ever wonder how high your medical bills could potentially go? MOOP sets that limit.Understanding Maximum Out of Pocket (MOOP)

Defining MOOP

MOOP stands for Maximum Out-of-Pocket. Picture it as a spending cap, like the ceiling of a room, beyond which your Medicare Advantage plan begins to cover 100% of your costs.How MOOP Works

Imagine you're filling a bucket with water (your medical expenses). Once it's full to the brim, you don't need to add any more. Similarly, once you reach your MOOP limit, you won't pay any more for covered services.

Differences Between MOOP and Traditional Deductibles

It's easy to confuse MOOP with traditional deductibles. Think of MOOP as the entire depth of a swimming pool, while the deductible is just the shallow end. Deductibles are the initial costs you pay, whereas MOOP is the absolute maximum for the year.The Benefits of MOOP

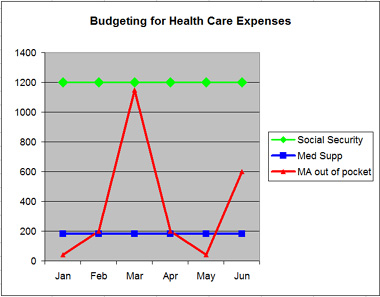

Financial Protection

MOOP acts as a buffer. It's like having an umbrella during a rainstorm; even if it pours, you're shielded from the brunt of it.Predictability

Knowing there's a cap on your medical expenses offers peace of mind. It's akin to knowing there's a safety net while tightrope walking; you're secure, no matter what.Encouraging Preventive Care

Because of MOOP, people are less likely to skip important medical appointments. It's like owning a car with a warranty; you're more likely to get regular check-ups, ensuring everything runs smoothly.Limitations and Considerations

Coverage Gaps

Like any system, Medicare Advantage with MOOP isn't flawless. It's essential to understand what's covered and what's not. It's like knowing the zones of an umbrella; some areas shield you from rain, while others might let a few droplets through.Network Restrictions

While Medicare Advantage offers a plethora of benefits, it may come with certain network restrictions. Think of it as a VIP event; it's fantastic, but you might need specific credentials to get the most out of it.FAQs

- What costs count towards MOOP? Most out-of-pocket costs related to covered services count towards MOOP. This includes deductibles, coinsurance, and co-pays.

- Do premiums count towards MOOP? No, monthly premiums don't count towards your MOOP.

- Is there a standard MOOP for all Medicare Advantage plans? No, MOOP limits can vary between plans, but there's a maximum limit set by Medicare each year.

- Can MOOP change year to year? Yes, the MOOP can be adjusted annually by Medicare.

- What happens if I switch Medicare Advantage plans halfway through the year? Your out-of-pocket expenses will reset, and you will need to meet the MOOP for your new plan.

Conclusion

Navigating the intricacies of Medicare Advantage and understanding MOOP can seem like unraveling a complex puzzle. But with the right guidance and insights, you can ensure you're adequately covered and financially protected. Remember, knowledge is power – and in this case, it's the key to sound health and peace of mind. Our office helps with all types of Medicare plans. Click here if you'd like our help.Maximum Out of Pocket on Medicare Advantage: Explained Read More »